Volatility Index Says Stock Market Crash Could Be Looming

There’s something interesting happening and it’s being ignored by optimistic investors; bets on a stock market crash and volatility are increasing. Stock investors, beware.

To see how investors are betting on a stock market crash and for volatility to increase, look at the Chicago Board Options Exchange (CBOE) Volatility Index (VIX). This index is often called the “fear index.”

Essentially, VIX is a volatility expectation index. In other words, it tells if investors are expecting volatility on stock markets in the coming days and months. It’s calculated by looking at various options of the S&P 500.

If the fear index increases in value, it basically says “be very careful.” A sell-off could be ahead.

Since the beginning of 2018, we have been noticing a massive spike in the VIX. Look at the chart below.

Chart courtesy of StockCharts.com

Since early January, the fear index has jumped nearly 50%. Now, look at an even bigger picture.

Chart courtesy of StockCharts.com

Over the past one-and-a-half years, the VIX was trending lower.

The move that happened since the beginning of 2018 has taken the fear index above the downtrend. Remember one technical analysis rule: the trend is your friend until it’s broken. If the downtrend is broken, we could see the fear index soar much higher.

As this is happening, there’s one more thing to note; the fear index is soaring and foretelling a stock market crash when key stock indices continue to trade near their all-time highs. This is not a good combination to have whatsoever.

What’s Next for the Stock Market?

Know that key stock indices have had a solid run since the bottom in 2009. If you had bought some index fund tracking the S&P 500, you would have done great, especially in the last one-and-a-half years.

The S&P 500 soared over 30% in the last one-and-a-half years. Relative to historical average returns, this was beyond amazing.

Dear reader, I have said this before and I have said it again; investors have made a lot of money over the past eight years or so. Stock markets just increased without any hiccups.

If the VIX suggests that bets for a stock market crash are increasing, it might be time to be careful.

This time around, you may not need anything to go wrong. For example, the U.S. economy doesn’t have to fall off a cliff, nor do the earnings growth rates need to tumble. We could see a stock market crash just on profit-taking.

Think about it this way; how do you think investors who bought in early January will react if there’s a correction of even five percent on the stock indices?

My take is that they could be panicking and selling. This, in turn, could cause a broad market sell-off.

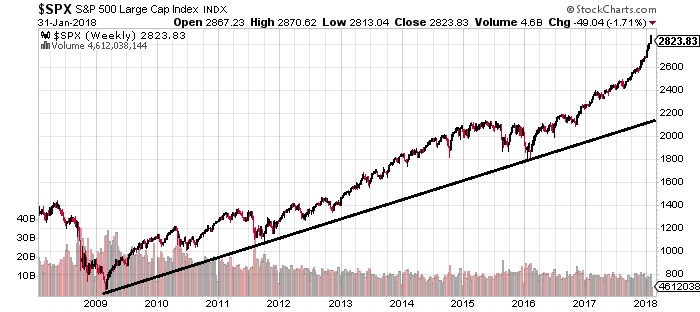

I will end with one more chart. Pay close attention to the black line drawn.

Chart courtesy of StockCharts.com

Even if we assume the trend on the S&P 500 that began in 2009 continues, the price has really stretched away from this trend. If it comes back to the trend, then the S&P 500 would have to drop to around 2,200. If this is the case, then the index would have to drop more than 20%—that’s a bear market.